Tech investors had a whale of a time

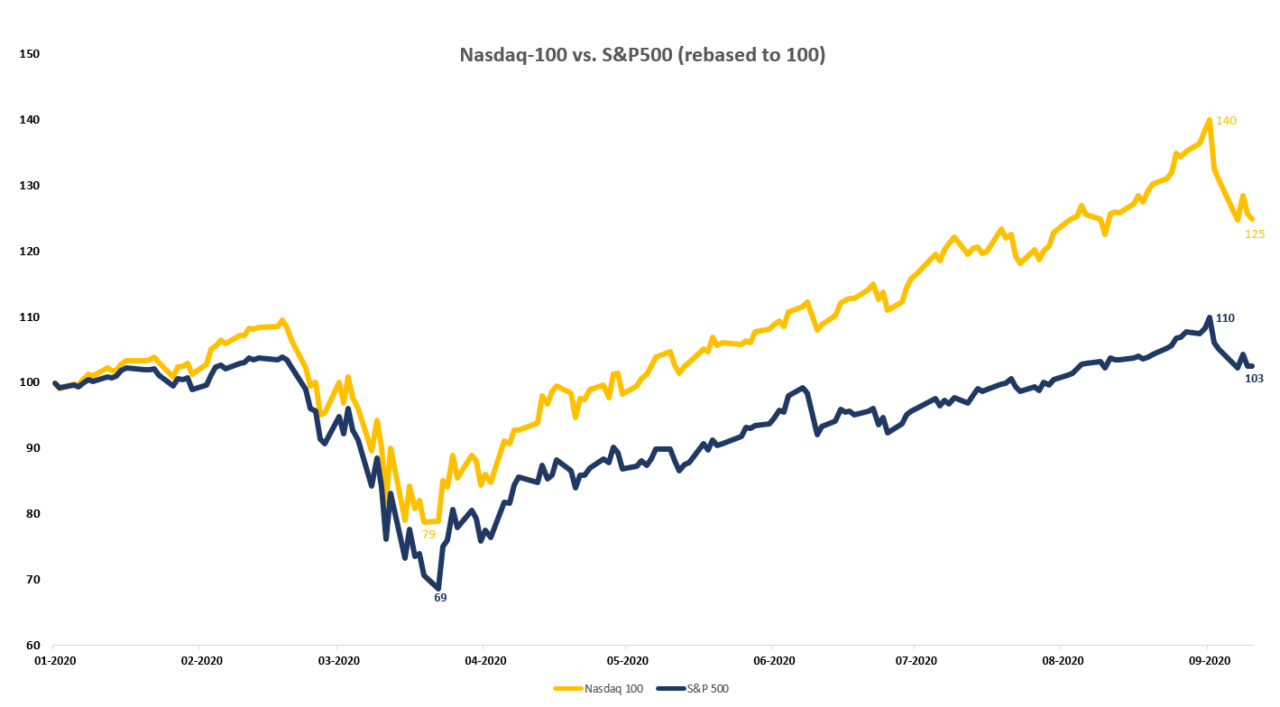

The tech-heavy Nasdaq 100 has dominated the headlines over the past 6 months and with good reason. After the markets crashed between February 19th and March 23rd, the Nasdaq-100 bounced hard and was already back to its February levels by the start of June.

The plucky S&P 500, which has had a terrific recovery in its own right, only got back to record highs by August – positively pedestrian compared to the Nasdaq-100.

By September 2nd, the Nasdaq-100 was up 40% year-to-date. Read that carefully. Not 40% since the crash, but 40% since the start of the year. That’s extraordinary. At the same date, the S&P500 was up just 7% for the year.

In case you’re curious, the trough-to-peak return on the Nasdaq-100 is nearly 80%. The comparable return on the S&P500 is 60%, weighed down by having many companies in the index that suffered over lockdown.

What goes up, might come down?

Apple broke through $2tn market cap. Tesla put smiles on many faces, despite barely generating a rolling 12-month profit. The sun was shining and the market was charging.

On September 3rd, the music stopped. A Nasdaq-100 sell-off began that wiped 11% off the index in barely a week. September 3rd itself was the largest decline from a record high in the Nasdaq’s history. The S&P500 of course includes a number of companies that are also in the Nasdaq-100 and dropped around 7% over the last week.

We must point out that when a market has been driven this hard, there simply has to come a point at which the market suffers a correction. It’s inevitable. It either vindicates your view or offers another buying opportunity, depending on your outlook.

We are bullish on global tech and so our view is that this is a blip on a long-term trend and does offer a buying opportunity for South Africans, assisted by recent Rand strength.

What drove this rally and subsequent correction?

There was a decent amount of fundamental support for the rally. Unlike the Dot-Com bubble, the tech giants are now intertwined in our daily lives. You would have to be a rainforest dweller who lives off the land to avoid using the products of these tech companies every day.

During a period of economic stimulus and excess liquidity worldwide, the US became a safe-haven for cash and tech stocks became a popular choice. To be fair, the results of many tech companies supported this notion, demonstrating that these companies weren’t just defensive during a crisis, but benefitted from it.

Profits were strong and so were the underlying cash flows. Cloud computing and eCommerce packed a few years of expected growth into just a few months. Lockdown was favourable to tech.

However, the profits couldn’t fully explain the rally. Traded multiples were blowing out, as investors fought over each other to pay more per Dollar of earnings. Many became concerned about the short-term headwinds of demanding valuations, lack of consensus over further stimulus in the US and ongoing tensions between the US and China.

There have also been concerns about the potential impact of Robinhood on the market – the app that brought literally millions of new retail investors into the market, many of whom traded leveraged instruments. The younger demographic of these investors led them to focus on tech stocks, especially those with charismatic leaders.

Tesla and the whale

Even against the backdrop of the 2020 rally, Tesla stands out. Before the September correction, it was up 465% year to date. One can likely attribute this to the Robinhood faithful who idolise Musk.

To the surprise of many, S&P did not include Tesla in the S&P500 index. The resultant 35% drop in the Tesla share price was a major contributor to the dip in the overall market.

Another major contributor was the unmasking of a whale – Softbank. Financial Times broke the story that the Japanese financial powerhouse had been buying call options worth $4bn, giving exposure to $30bn of underlying tech assets. Softbank declined to comment on the story, which is another way of admitting that it’s at least partially true.

$9bn of Softbank’s market cap was wiped out on the first trading day after the report.

Sure enough, Bloomberg now reports that Softbank is rethinking its investment strategy. Retail shareholders in Softbank may be relieved to hear that, because it sounded like Softbank had turned itself into a high-risk hedge fund.

It isn’t clear whether Softbank used call spreads or highly leveraged short-term structures, but the end result in the market was a need for sellers of the options to buy the underlying shares to hedge their positions. Softbank’s massive leveraged positions became a self-fulfilling prophecy, helping to drive the prices up.

For a while, at least.

The Financial Times also reported that retail traders put nearly $40bn into similar trades. Softbank may have been the biggest single investor in the market, but a Robinhood army had a larger impact.

Long-term views are still the answer

It’s useful to understand the drivers behind short-term movements, but it’s far more important to ask yourself whether this changes your fundamental views.

After confirmation that the South African economy saw GDP shrink around 16% in Q2 vs. Q1, it remains our view that investors should be diversifying away from South Africa as much as possible. The sell-off in global tech doesn’t change the long-term trajectory for many of these companies but does highlight the value of an active strategy in volatile markets.

Our Unicorn and Altos Funds remain attractive options in this environment. The recent sell-off simply offers a useful buying opportunity.