2021’s market performance has been tame relative to 2020. That’s unfortunately how this investment game works: no two years are the same.

The South Africa market has had a solid year, as emerging markets played catch-up and many of our unloved small- and mid-cap stocks finally received some crumbs off the edge of the table.

Here’s some perspective though: the JSE All Share Index increased 25.2% over the 12 months to the end of August 2021. The S&P500 and Nasdaq-100 both grew by around 29% over the same period.

The JSE kept pace for once, but that was driven mainly by companies closing large valuation gaps rather than strong underlying earnings growth. US giants are still reporting double-digit revenue growth numbers every quarter. As their products continue to penetrate countries around the world, their growth runway still looks exciting.

When measured in Rand, the JSE has outperformed the US market over that 12-month period.

The juxtaposition of the Rand and South Africa’s unemployment rate is fascinating. The Rand is relatively strong, yet the unemployment rate in South Africa is the highest we’ve seen since 2008. To understand this, it’s critical to realise that the Rand isn’t always driven in the short-term by the on-the-ground economic realities in South Africa.

Our currency has fought back effectively this year, driven by sharp jumps in commodity prices. Whether they are sustainable or not is up for debate, but recent weakness in Platinum Group Metal (PGM) and iron ore prices suggests that the best may be behind us. The key measure to watch is the South African trade surplus, which is likely to come under pressure in coming months. Rand weakness could be the theme for the next year and since last week when this piece was written the ZAR has already sold off significantly.

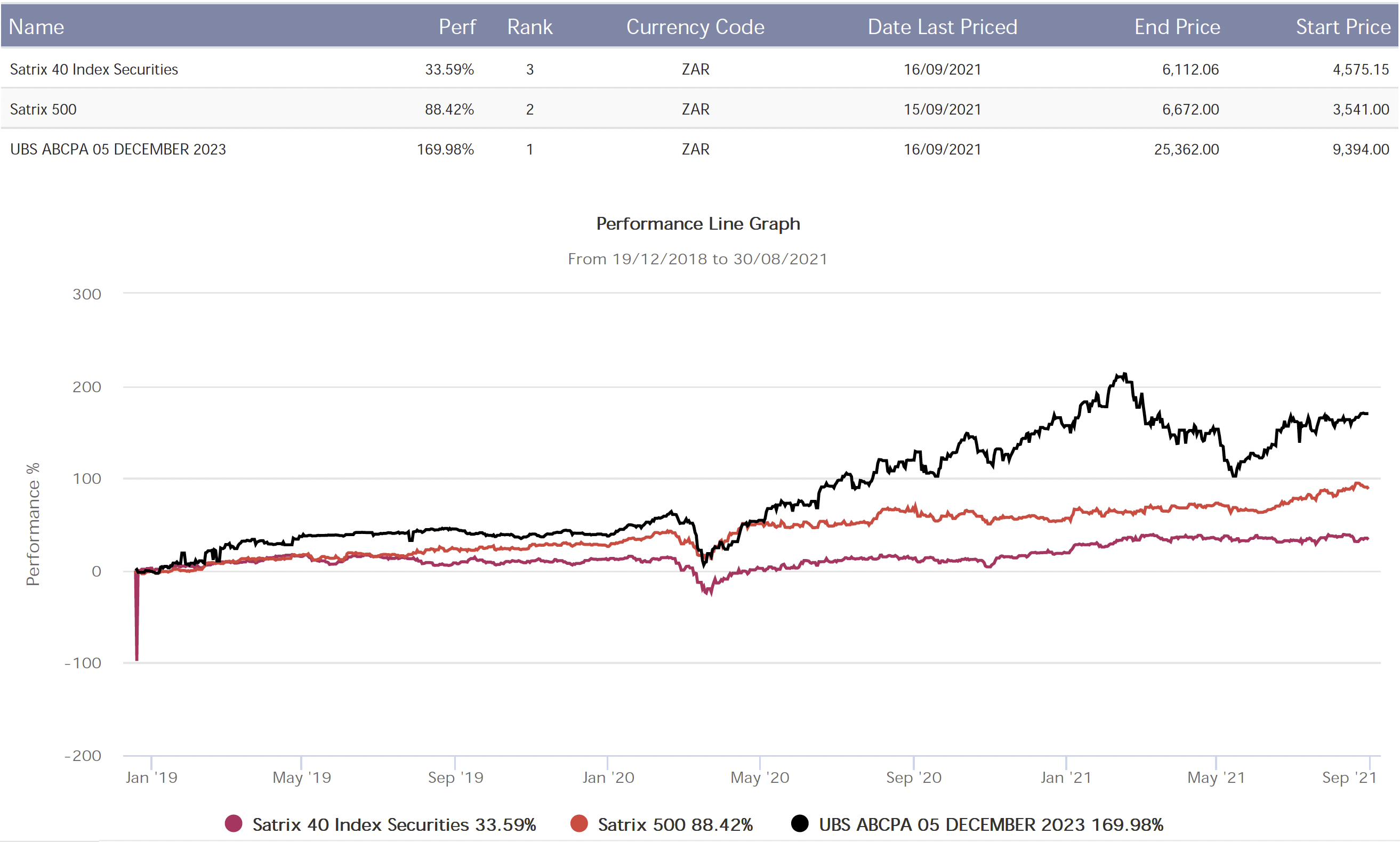

Although Resources have had a solid year so far on the JSE (up 19.8% to August), that performance has been eclipsed by Financials (22.6%) and Property (27.4%). These two sectors provide a window into the general economic health of the country, so their three-year performance is well worth looking at.

Unfortunately, they are the two worst performers over that period. On an annualised basis, Property and Financials are down -7.3% and -1.0% respectively.

It speaks volumes for the local market that the second-best performer over a three-year period is Bonds, up an annualised 10.0%. Once you take tax into account on these performance numbers, you were better off paying off your mortgage.

This is why the recent JSE performance is a dangerous distraction. It was a short-term opportunity to close a few valuation gaps, but that cycle has now played itself out. The macroeconomic realities are clear and our country is extremely vulnerable to what happens in key commodity prices going forward.

Our view remains steadfast: a wealth creation journey is strengthened through focusing on high-growth regions and diversifying around that theme. As a cyclical play, South Africa has rewarded investors in the past year. Over the next five years, would you rather bet on the biggest brands globally, or South African stocks growing in the domestic market?

Over the 12 months to August 2021, our Unicorn Fund returned 36.32% in USD, beating the large market indices by over 700bps, while our Reg.28 Retirement Fund returned 22% over the same period

As a reminder that this journey isn’t easy, we leave you with a quote from Nick Dennis of Anchor Capital from a letter he wrote in July 2021:

“Why do so many people have a bad experience when investing, where every move is felt with agonising intensity, often leading to capitulation at the worst possible time?

I suspect it starts with expectations that are too high and generally inconsistent with reality. Another problem is a lack of understanding of the market in general, including what matters and what doesn’t.

When you explain what people should expect, they’ll invariably say they understand and are fully on board. But real understanding is not intellectual, it is visceral. True understanding happens not in the brain, but in the guts. It’s one thing to imagine being down 50% in a position and another to go through it.

While the market isn’t a person and doesn’t have a mind of its own, it can nevertheless feel that way. It’s as if the market’s intent is to push you to your breaking point. And sadly, many investors do break.”

The reward is well worth the journey.