Unicorn shines through the September tech sell-off

In light of the recent sell-off on the Nasdaq of the world’s finest tech stocks, we felt it was worth reflecting on the resilience of the Unicorn Fund to these market moves.

Things go up and things go down. That’s normal. The effect cannot be mitigated through a single passive exposure to the market, as your investment will ebb and flow with the overall market. However, in an active management environment, fund managers can utilise strategies to mitigate the downswings and amplify the upswings.

Of course, it doesn’t always work. Nobody can beat the market every time. Nonetheless, we are thrilled to report on the performance of the Unicorn Fund over the period of this sell-off:

FAANG stocks (Facebook, Amazon, Apple, Netflix and Google (Alphabet)) have had a horrible September. High valuation multiples are always a recipe for a pull-back and concerns over US-China issues and the general economy have driven a cooling-off of investor sentiment.

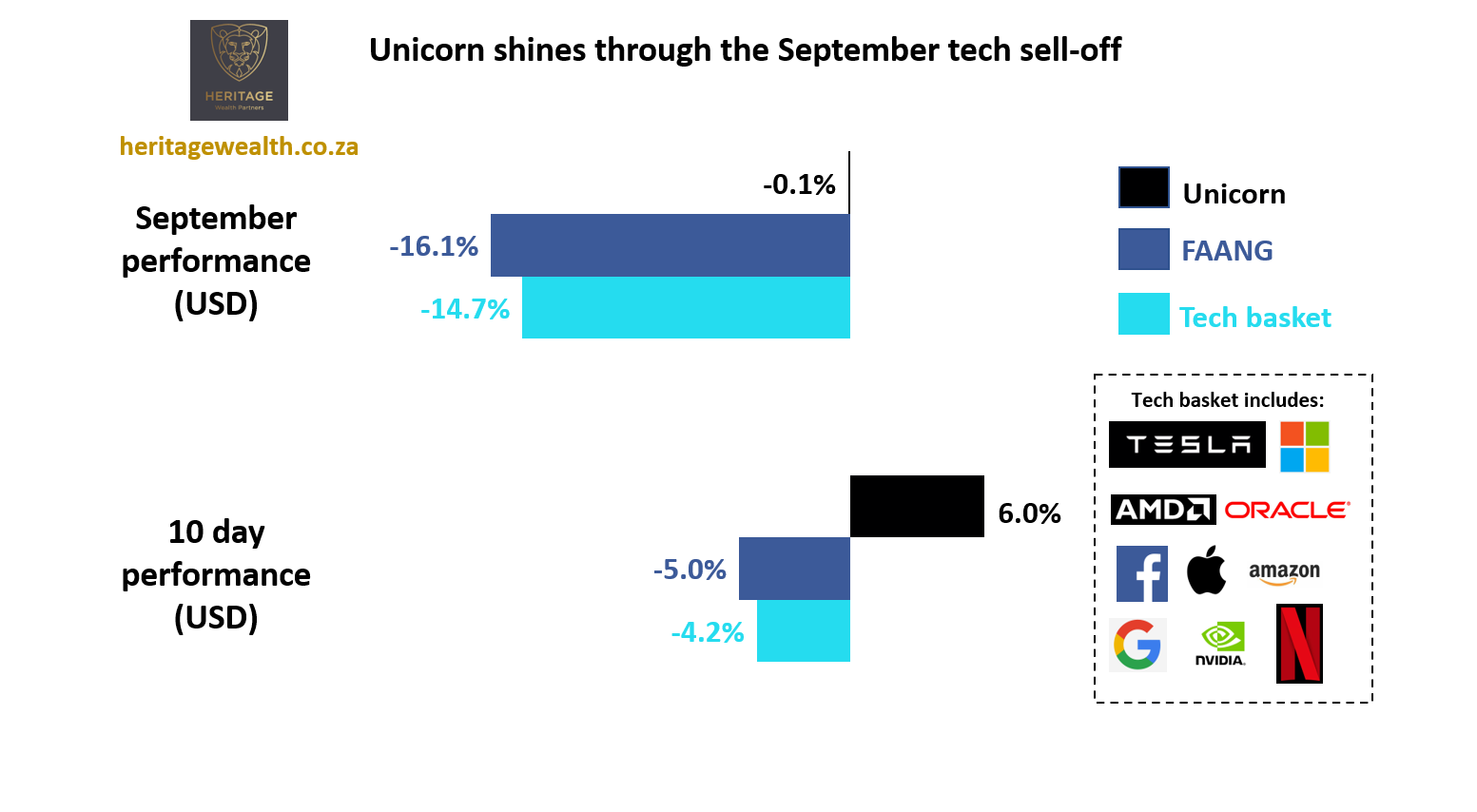

We have also included an expanded tech basket, which includes FAANG as well as Microsoft, Tesla, Oracle, NVIDIA and AMD. These have been popular choices recently. The basket in the chart is weighted by market cap.

In both cases, Unicorn has shown remarkable resilience. Since September 1st, Unicorn is flat in USD (which means you are +1.4% up in ZAR) while the FAANG basket has dropped -16.1% and the larger tech basket is down -14.7%.

Recent trend is strongly positive for Unicorn. Between September 14th and September 24th, Unicorn grew 6% while the tech stocks continued to drop, albeit at a much slower pace than in the first two weeks of September.

The lesson here is that global exposure is critical for South African investors but needs to be carefully (and actively) managed. Through the Unicorn Fund, our clients obtain access to a terrific global portfolio in a low-fee structure.

Take another look at the chart and decide for yourself. Contact us today if you are ready to believe in unicorns.