If anything, the events of the past few weeks have reminded South Africans of the differences between an investment risk and an existential risk.

In the week before the protests and looting that horrified all of us, the narrative in the market was dominated by the risks in Chinese tech stocks. Of course, burning warehouses in South Africa don’t affect Chinese risks. They just remind us that there are varying degrees of risks.

The need for offshore diversification is a drum that Heritage Wealth Partners has been beating since we began advising clients. Being a patriotic South African and sporting the green and gold jersey at the braai doesn’t mean that all your money should also be dressed in Springbok supporter gear.

There are investment risks in every region.

In the US, there is still a push towards regulation of the “Big Tech” stocks, although Facebook won a critical court battle just before Independence Day. Zuckerberg’s celebratory Instagram video, in which he was hydrofoiling while waving the American flag, was an entertaining look at life in the West.

Things have been far unhappier for Chinese tech executives. The Chinese Communist Party (CCP) has been sending multiple warning shots since the listing of Ant Group (Alipay) was pulled in 2020. That was really the start of the worries over Chinese regulatory interference, as Jack Ma literally disappeared from public view for an extended period.

Jack has returned to the public eye, but valuation multiples haven’t returned to where they were. The latest catalyst for concern was the listing of Chinese ride-hailing app DiDi. The valuation was crushed within a week of listing in the US because the Chinese government pulled the app from app stores over data privacy concerns.

As a result, companies like Alibaba and Tencent have been under pressure, which has scared some investors away. Others view this as an opportunity.

The beauty of investing is that opposing views create a market!

Many of these Chinese tech stocks have simply been caught in the crossfire of US-China relations. If things really escalated, then companies like Apple are arguably just as risky as Alibaba. As is so often the case in global affairs, the animals growl at each other but avoid going in for the bite, out of fear of being bitten instead.

The ultimate risk of Chinese stocks is the VIE structure, which is a complicated legal arrangement that enables foreigners to have a claim on profits of Chinese companies in restricted sectors. Importantly, owning “shares” in Alibaba or Tencent doesn’t represent a genuine shareholding in those companies, as ownership by foreigners is prohibited.

Technically, in court, the VIE structure could fail legally. The CCP has turned a blind eye thus far and is likely to continue doing so, as the alternative approach would crush foreign investment and could send the Chinese economy back to the dark ages.

As we’ve learned very recently, the likelihood of extensive disruptions in South Africa or even a violent coup is higher than the VIE structures falling over. If “black swan events” like this (low probability; maximum negative impact) keep you up at night, Chinese investments are the least of your concerns as a South African.

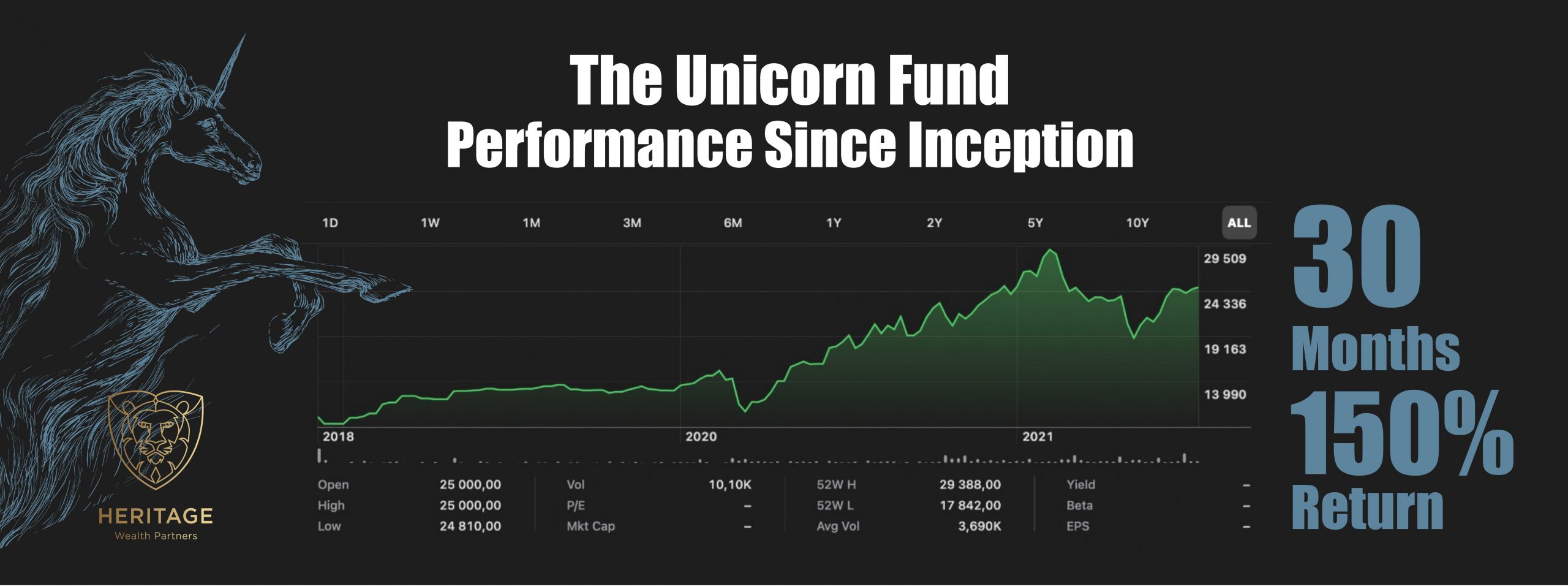

Our Unicorn investment fund is a powerful example of the benefit of active asset management. There is clearly an opportunity in China, but it is important to balance this against the risks.

The fund’s exposure to China is around 5%. Overall exposure to emerging Asia is approximately 8%. Importantly, the fund owns several interesting Chinese stocks in the ecommerce, social networking, data centre, food delivery and gaming sectors.

Stock-specific risk is low and the fund is diversified within a broader Chinese theme. The political and regional risk is real, although this does create an opportunity for a positive re-rating if the Chinese approach becomes less heavy-handed. Equivalent US companies trade at much higher multiples than Chinese peers.

Ultimately, a broad clampdown on the tech industry is unlikely. The view of the Unicorn fund managers is that regulatory interference will be on a case-by-case basis. This can be mitigated by being selective about companies in the fund, while ensuring a reasonable spread of investments in the region.

Risk must always be assessed against opportunity. This is the benefit of a global, actively-managed strategy like our Unicorn Fund.