Investing Is An Intangible Art

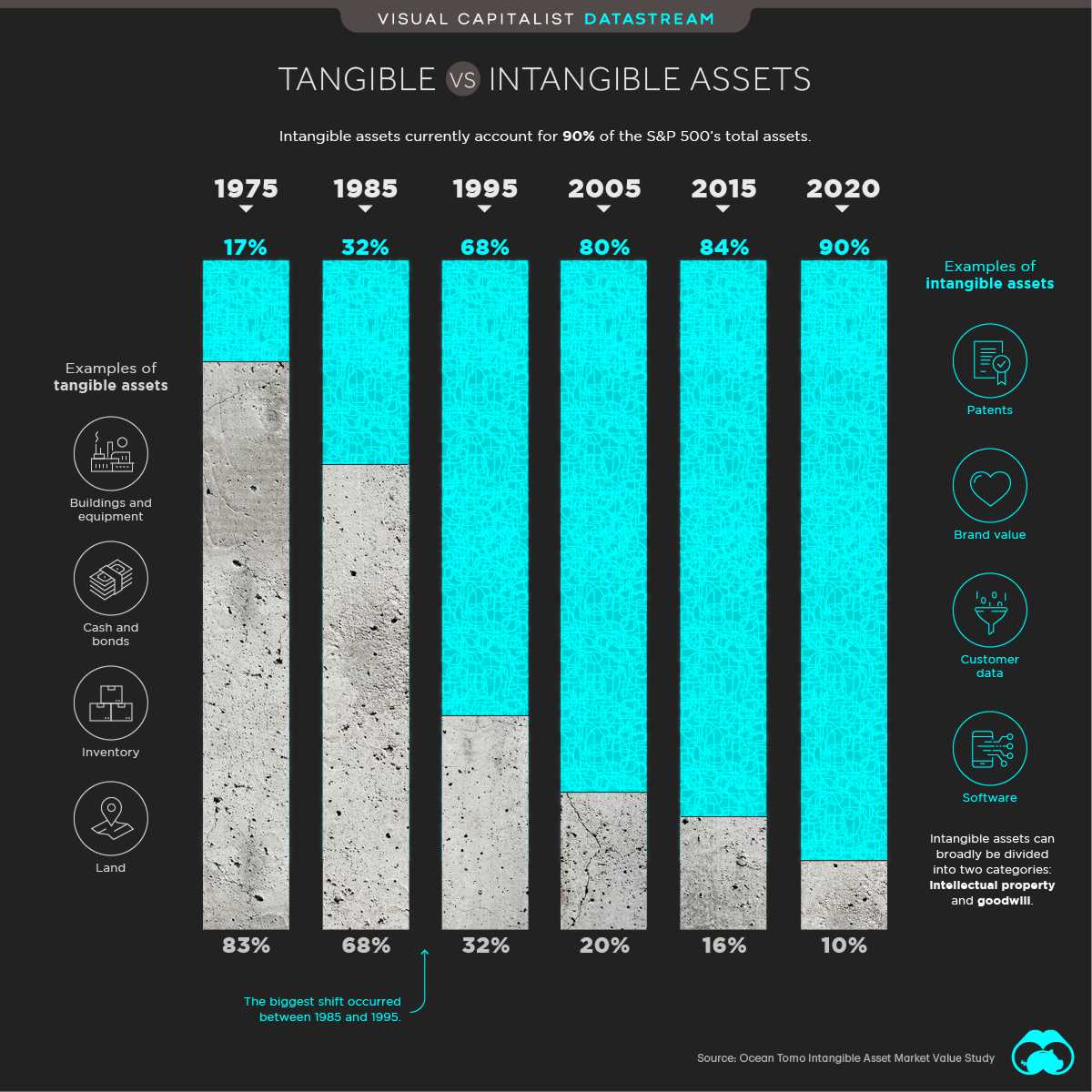

On a daily basis clients ask me about tech shares and valuations, so in this article I wanted to help you understand how companies with Intangible assets can be valued. Visual Capitalist reports that intangible assets currently account for around 90% of the S&P 500’s total assets.

But what does this mean?

The total assets on the S&P 500 would be calculated by adding up the assets of every underlying company. These are accounting book values recognised on the balance sheet, so this is nothing to do with the actual traded value of each company (its market capitalisation).

Total assets includes intangible and tangible assets.

Intangible assets would include things like trademarks, patents, software and goodwill. There are strict accounting rules around recognising these assets, to avoid companies artificially bumping up their balance sheets.

Understanding the accounting principles isn’t very important. What is important is the trend in intangible assets as a percentage of total assets on the S&P 500:

- Between 1985 and 1995, this percentage grew from 32% to 68% as the internet economy started to gain traction

- From 1995 to 2005, it jumped again from 68% to 80% as the world found its feet after the Dot Com Bubble and internet models began to mature

- Over the next 15 years to 2020, as the smartphone became ubiquitous and our lives changed completely, the number grew to 90% of total assets

This means that for every $1 of physical assets held by S&P 500 companies, a further $9 of intangible assets exists.

Welcome to the technology age.

Traditional valuation models aren’t always appropriate

Traditional accounting ratios don’t always make sense anymore. Because of strict rules around recognition of intangible assets, high-growth tech companies often trade at significant premiums to book value.

The concept of “book value” hasn’t evolved in line with how the market values these companies. Whether or not accounting standard-setters need to give the rules a rethink is a topic for IFRS accounting specialists to worry about, but the reality is that the world has changed and the investing community has changed with it.

But the base principle still applies: don’t overpay

A great company isn’t always a great investment. A company in a tough spot isn’t always a bad investment. The age-old relationship about value and price will apply forever in investing no matter what the economy does or how the markets evolve.

If anything, investing has become more difficult rather than easier. The proliferation of intangible assets and the decoupling of accounting and valuation concepts has made it trickier to identify when a company is genuinely overvalued.

It isn’t accurate to conclude that companies on high multiples are over-priced, as we are seeing platform models that can achieve extraordinary growth rates which quickly “unwind the multiple” as the company grows.

Equally, it isn’t accurate to assume that every tech company is capable of achieving these growth rates. More and more, we are seeing “winner takes all” economics playing out, where only one or two firms within a given business model manage to succeed.

What does this mean for our approach?

Our approach is consistent and is appropriate for many of our clients: follow an active approach in building wealth with global exposure.

Through our Unicorn Fund and Altos Fund, we offer bespoke portfolios with low-cost structures and diversified underlying exposure.

INSERT ALTOS PIC HERE

The results speak for themselves. For example, our Altos Fund is a lower risk offshore portfolio with a unique strategy and has returned 14% this year in USD, a strong performance vs. the S&P 500 which has returned 11.5% and US cash or Bonds returning only 0.15% and 0.58% per year.

[Unicorn has returned 56% vs. NASDAQ composite (a higher risk index) which has returned 31% this year.]