SA mid-caps: best for traders, not wealth creators

If FinTwit (market commentators on Twitter) is a reliable gauge of investor sentiment, there’s a shift in focus among South African institutional investors and analysts towards the unloved children in the small- and mid-cap space on the JSE.

This is largely because there are limits placed on South Africans in terms of international exposure. Above these limits, everyone is fishing in the South African pond whether they like it or not.

Individuals are allowed to make portfolio investments up to R10m a year (with permission) or R1m a year (without permission). Pension funds have specific limits that apply for offshore exposure, which is why Rand hedges are popular: the pension funds use them to gain indirect offshore exposure without breaching any limits.

If you have no choice but to invest in South Africa, then naturally you’ll look for the best South African opportunities. In the land of the blind…you know the rest.

Beyond the large caps

Large caps with international strategies are often investor favourites, but they trade at demanding multiples and any strategic missteps can be extremely painful for shareholders. Well-known examples include Famous Brands and Woolworths, both of which made disastrous moves offshore through large transactions in markets they didn’t understand.

Small- and mid-caps typically trade at lower multiples. They inevitably get smashed in a crisis and take longer to recover. Due to lower institutional investor activity in this space and lack of liquidity, share price moves are often lumpy and based on a specific catalyst, like an earnings announcement.

Large cap share prices usually tick up over a year, only rerating with a significant jump or drop when there is an earnings surprise or a corporate action. When large caps are trading at unattractive high multiples, institutions start to look at smaller companies instead.

In an efficient market, one would argue that the lower multiple reflects the higher risk of these companies, so the risk-return relationship holds for large and small caps.

Luckily for financial professionals, the market is far from efficient.

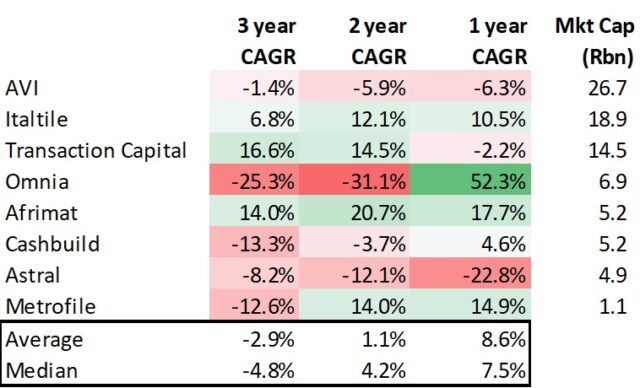

If there was no mispricing on the market, then you wouldn’t see a fruit salad of returns in the small- and mid-cap space like this:

Obviously, the average and median return will change depending on the basket of stocks, but this is a reasonably diversified basket across sectors and sizes. It’s a fair reflection in our view of the type of portfolio an investor might have built in the JSE small- and mid-cap space in the past few years.

Assuming an equally weighted portfolio (i.e. the average), the investor would’ve lost money over 3 years (-2.9% CAGR), not even beaten inflation over 2 years (1.1% CAGR) and barely beaten fixed income fund returns in the past 12 months (8.6%).

But what if you are nowhere near breaching your Excon limits? Should you be considering a dip into the deeper sections of the JSE where few are brave enough to swim?

To trade? Maybe. To invest? No.

If you get it right, there are strong profits to be made.

For example, Afrimat has done well. Omnia has been an incredible buy in the past 12 months (up over 50%) and terrible before that. Transaction Capital has been good over 3 years but has had a slow 12 months.

Italtile has been a dependable company but those aren’t returns to get too excited about. The list goes on.

You can trade SA Inc mid-caps and you might do rather well, but the operative word here is “trade” as opposed to invest. An investment is something that you can put in your drawer for several years without losing sleep over.

Trading requires you to watch the market like a hawk, combining technical skills (entry and exit point) with a fundamental understanding of the company. Doing this effectively and profitably over time is well beyond the reach of most people.

SA Inc. small- and mid-caps are sadly tied to the fate of South Africa in one way or another. Sure, they are taking market share in some cases and perhaps starting to generate international revenue, but many of these companies are already market leaders in a market that simply isn’t growing.

For comparative purposes, take a look at FAANG returns in ZAR over the last 3 years:

A diversified global tech portfolio benefits from the unstoppable tide of platform businesses.

Even if we consider the risk of regulation and what that might mean for some of the FAANG companies, going one tier down into the emerging tech giants will reveal returns that are once again far in excess of what the JSE can offer.

We advise our clients to build wealth in the global arena

Trading on the JSE may be fun and watching the small- and mid-caps is a great way to learn about the markets and the drivers of a share price. However, it’s probably not your best option for genuine long-term wealth creation. So, if you feel the desire to dabble in this space, don’t bet the farm – or your retirement!

If you’ve hit your annual limit, you may think you have little choice but to buy SA Inc stocks. You’ll be pleased to learn that this isn’t the case.

We’ve already thought about this issue and co-developed a solution that gives you exposure to a high-performing, diversified global portfolio without utilising your annual limit at all (as the product is listed on the JSE). Should you be within your allowances and wish to physically send more cash offshore, the same portfolio is available on that basis.

Why would you choose to swim in a shrinking murky pond when there’s an option to swim in the big blue ocean instead?